British Steel and Brexit

As a global industry, steel prices and exports have been falling as demand decreases. Whilst the media reports on British Steel have focused on job losses, Brexit-related issues have played a greater role on its sudden demise.

British Steel has quality products and high productivity, but what factors have caused its failure?

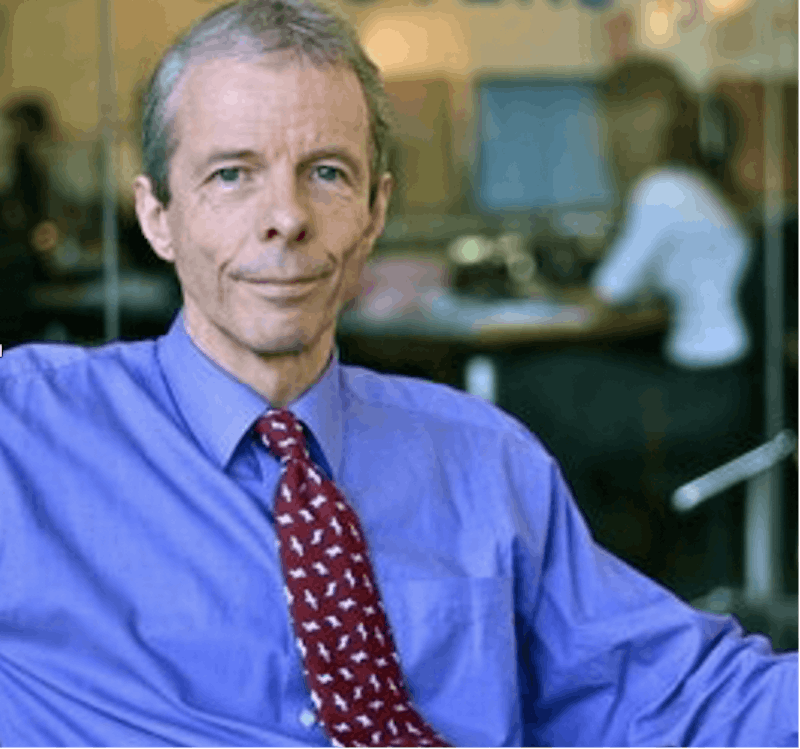

Professor Brian Scott-Quinn discusses in Henley Business School's Leading Insights. Read the full piece here.