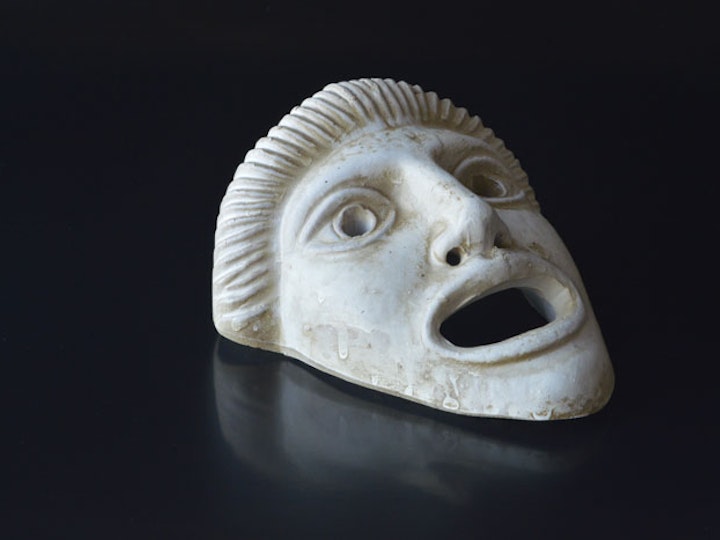

Debt deal: End of the Greek drama?

Agreement on Greek Bailout deal met with relief. But is this the end of the drama?

Agreement on Greek Bailout deal met with relief. But is this the end of the drama?

The deal reached yesterday at the Eurogroup for the €8.5 bil disbursement of the third instalment of the 86 bil Euro Greek bailout plan may not be as promising as it seems.

The good news is that another “hot Greek summer” (such as the one we experienced in 2015!) is averted. Despite the, once again, nerve-wracking negotiations in the run-up to the deal, it does seem that lessons have been learned this time around and the Greek government chose not to gamble further and take what was on the table.

The deal at a first glance might seem like an important step towards the stability of Greece which could potentially now turn the page and focus on the things it really needs to such as supporting and facilitating new investment and growth which - other than debt relief - is the only realistic path out of the crisis. So, the agreement itself doesn’t solve the underlying problem but paves the way for the Greek government to start delivering tangible results.

The deal is also important for the Eurozone. With German elections around the corner, the government there wanted this chapter closed, in a way of course that doesn’t raise eyebrows back home. We also have new data that reflect economic recovery may be on the way for the Eurozone. So this agreement - although it doesn’t just yet really tackle the Greek debt problem - can contribute towards breaking the clouds of uncertainty especially at a time when Brexit negotiations are set to begin.

Is this the end of the drama for Greece? Far from it I would say.

To see light in the end of the tunnel, yesterday’s promise for a generous debt restructuring in the next 12 months would need to materialise first. And reaching an agreement on the extension of Greek debt maturities, which could make Greece’s debt load more sustainable, will not be without complications. Perhaps even more importantly, the agreed long-term growth plan would need significant revisions to work out. As a starting point the Greek Economy would benefit from lower taxes, a more efficient public sector and deep reforms capable of attracting and facilitating investment. This, along with more generous debt relief, is the only realistic recipe for economic recovery to be attained. Given our experience so far with Greece’s bailout plans it would be surprising if is the end of the drama but do hope I am proven wrong!

Dr George Alexandridis on the Greek Debt Deal

Dr George Alexandridis @ BBC World News earlier today on the Greek Debt Deal reached yesterday at the Eurogroup

Posted by ICMA Centre on Friday, 16 June 2017

| Published | 16 June 2017 |

|---|