M&A Mega-Deals Create More Value Now than Ever Before

New ICMA Centre research by Dr George Alexandridis and PhD Nikolaos Antypas reveals mergers and acquisitions (M&As) create more value now than they ever have done before.

New ICMA Centre research by Dr George Alexandridis and PhD Nikolaos Antypas reveals mergers and acquisitions (M&As) create more value now than they ever have done before.

The fact that M&As tend to destroy value for shareholders of acquiring companies more often than they create is perhaps among the most well documented and puzzling facts in corporate finance market and academic research.

This tendency of M&As to fail is more accentuated among large acquisitions priced over $500m (mega-deals) according to a number of recent reports by Boston Consulting Group and McKinsey. Along these lines, a Financial Times article published in 2015 argues that mega-deals tend to involve high premia to target shareholders and are damaging for almost everyone else, except for top executives and financial advisors. A plethora of large mergers, from the frequently quoted landmark deals of AOL-Time Warner, Daimler-Chrysler, and HP-Compaq to more recent ones such as Rio-Tinto-Alcan, Bank of America-Countrywide, eBay-Skype, and Kmart-Sears, have all been branded as failures since they have resulted in sizable write-offs and shareholder losses.

A new era for M&As

New ICMA Centre research reveals that value creation from M&As may have reached a pivotal milestone and the high likelihood of large deals ending up in disaster is no longer the status quo. The study by Dr George Alexandridis and Nikolaos Antypas, co-authored with Prof Nickolaos Travlos from the University of Surrey, and titled Smart Mega Merger Deals: Value Creation on a Massive Scale, is the first to examine the characteristics and performance of M&As carried out in the post-financial crisis era, when a new wave of deals emerged in 2010, reaching a peak in 2015.

New ICMA Centre research reveals that value creation from M&As may have reached a pivotal milestone and the high likelihood of large deals ending up in disaster is no longer the status quo. The study by Dr George Alexandridis and Nikolaos Antypas, co-authored with Prof Nickolaos Travlos from the University of Surrey, and titled Smart Mega Merger Deals: Value Creation on a Massive Scale, is the first to examine the characteristics and performance of M&As carried out in the post-financial crisis era, when a new wave of deals emerged in 2010, reaching a peak in 2015.

The value of global and U.S. deals in 2015 surpassed $4tn and $2tn respectively, the highest on record since at least 2007 according to Deloitte’s M&A Index 2016 and the WSJ-Dealogic’s Investment Banking Scorecard. During this year, mega deals comprised more than 85% of the total U.S. M&A market value, representing the bulk of corporate investment and an important part of the economy (more than 5% of U.S. GDP).

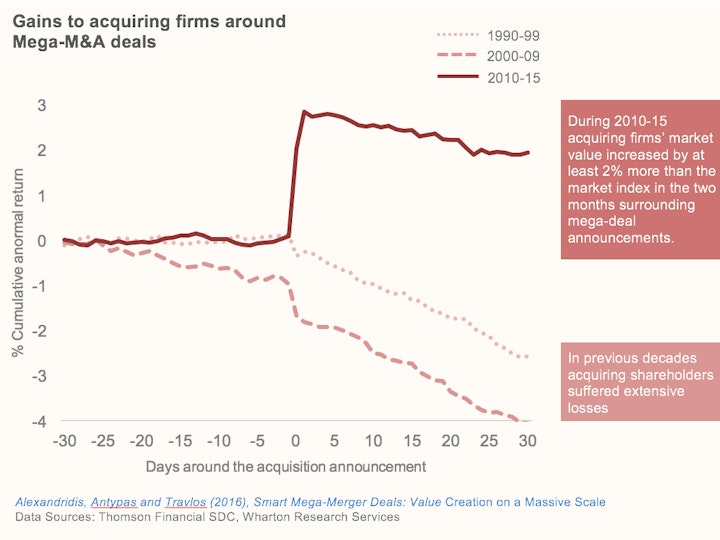

The study reports striking changes in deal attributes and quality, with acquiring firms creating discernible shareholder value through mega-deals post-2009 for the first time. Most notably, acquiring firm shareholders gained $62.3m more than the market around the announcement of a typical deal, a $325m improvement relative to pre-2010. A compelling 62% of large deals are now associated with positive market reaction compared to only 45% in the previous decade and 49% during the 90s.

More importantly, the overall synergistic gains have improved dramatically – more than five-fold – with the average deal generating a $542m combined abnormal gain for acquiring and target companies – the highest ever documented by any previous U.S. study. A number of recent deals stand out such as the Johnson & Johnson-Synthes deal in 2011, Facebook’s acquisition of WhatsApp in 2014, Pfizer-Hospir’s tie-up in 2015; all being received favourably by the market and with the potential to create tangible synergistic benefits for investors. The performance of recent mega-deals such as ABInbev-SABMiller’s in 2016 corroborate the results of the study.

Why do mega-deals now create more value?

The documented findings are indicative of a recent structural shift in the quality and drivers of M&As, and point to value creation from mega-deals on a massive scale, contradicting the status quo that acquisitions destroy value more often than they create. A number of indicators and tests suggest that this remarkable improvement in acquisition performance is concurrent to a more general change in the investment behaviour of firms and corporate executives and can be largely attributed to unprecedented corporate governance developments in the aftermath of the worst financial crisis since 1929.

The study marks a milestone in existing knowledge on acquisition gains and challenges conventional wisdom that firms destroy shareholder value more often than they create when carrying out sizable acquisition investments. Its findings also imply that a financial crisis of grand scale and its shockwaves can ultimately contribute towards more effective monitoring of corporate investment selection decisions as well as the M&A implementation and integration processes, yielding sizeable benefits for investors.

Is this a permanent trend or will it dissipate with time? It remains to be seen…

| Published | 14 November 2016 |

|---|