ICMA Centre Research Makes Conference History with Double Award Win

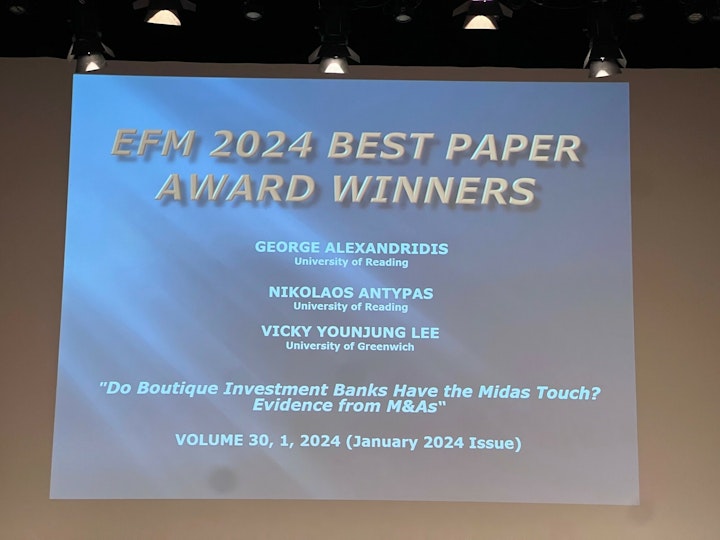

We are proud to share that ICMA Centre academics Professor George Alexandridis and Dr Nikolaos Antypas, together with co-author Dr Vicky Y. Lee (University of Greenwich), have received both the Best Paper Award and the Readers’ Choice Award at the European Financial Management Association (EFMA) 2025 Annual Conference that took place in June 2025 in Athens, Greece.

Their paper, “Do Boutique Investment Banks Have the

Midas Touch? Evidence from M&As,” is the first in the

conference’s history to win both awards, an exceptional

achievement that reflects the rigour of their research and its powerful

real-world relevance.

Do boutique banks really have the Midas touch?

The study provides large-scale evidence that acquiring firms advised by boutique investment banks generate significantly higher shareholder returns than those advised by full-service institutions. This effect is especially strong in complex and information-sensitive deals, such as private or cross-industry acquisitions.

By leveraging their industry specialisation and offering truly independent advice, boutique advisors were shown to create up to an average of $104 million in additional shareholder value per deal. The findings challenge traditional assumptions about the dominance of bulge-bracket banks and highlight how focused, expert advice can lead to superior outcomes in M&A.

As the landscape of corporate finance continues to evolve, the research offers timely insights for executives, investors, and policymakers, emphasising that when it comes to creating value, bigger isn’t always better.