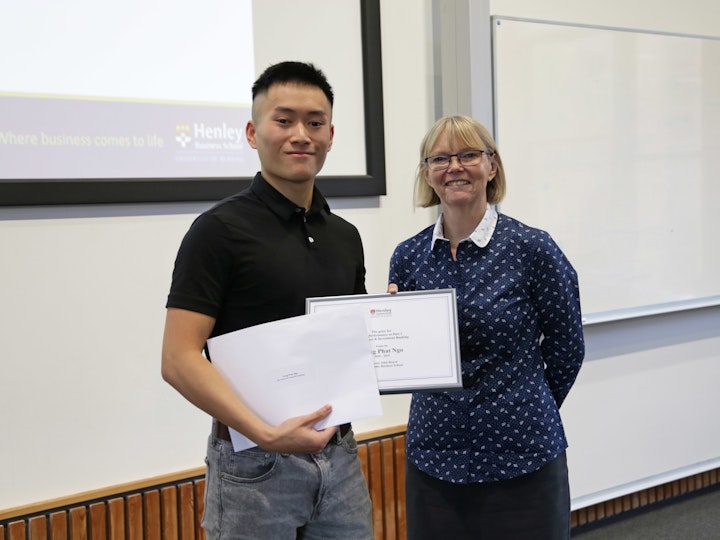

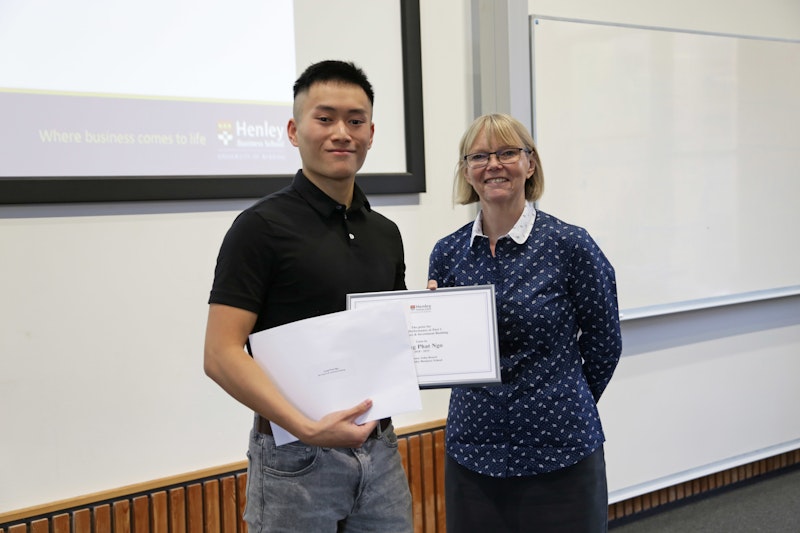

Best performing undergraduate students 2019

Students from the BSc Finance and Investment Banking programme were awarded their prizes by the Head of School.

Exceptional students in the BSc Finance and Investment Banking programme were recognised for their achievement. As the new academic year commenced, Dr Carol Padgett, the Head of ICMA Centre gave out prizes to undergraduate students during their welcome presentations.

Phat Ngo won the award for the Best Performance at Part 1 BSc Finance and Investment Banking. On receiving the award he commented:

“Throughout my life, I have always had the determination and mindset to succeed but to not shy away from failure. Although the award has meant that I performed well academically and has provided me assurance that I am on the right track, it will not hinder my determination to succeed nor will it make me any more afraid taking risks or fail.”Phat Ngo, Part 1 prize winner

Baoshun Yan, who is now in part 3 received £150 for his prize. This is also the second year in a row Baoshun has won the award. He also commented on the award:

“I am very grateful and excited to receive the Best Performance Award. The Finance and Investment Banking programme’s combination of research rigour and practical skills provides an incomparable preparation for further study and an excellent foundation for working in the financial services industry. I look forward to pursuing postgraduate study in the field of finance.”Baoshun Yan, Part 2 prize winner

Well done to both students for their great achievements!

1 / 2

| Published | 4 October 2019 |

|---|