ICMA Centre welcomes international students for research project

We’re delighted to welcome students from the University of Mary Washington (UMW) from Virginia in the US to take part in two University of Reading Undergraduate Placement (UROP) projects based at the ICMA Centre. This is the first time that the UROP programme has been opened to international students.

We’re delighted to welcome students from the University of Mary Washington (UMW) from Virginia in the US to take part in two University of Reading Undergraduate Placement (UROP) projects based at the ICMA Centre. This is the first time that the UROP programme has been opened to international students.

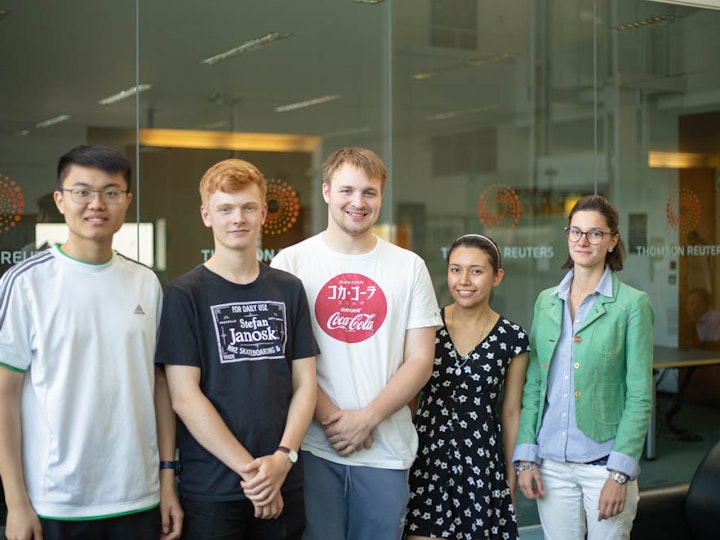

Students from UMW will work alongside students from the University of Reading (UoR) on two projects: Marine insurance in the Middle Ages and Seasonality in the Medieval Financial Market.

Giulia Cioli (UoR) and Andrew LaMarca (UMW) are working together to look at Marine Insurance and uncover whether or not medieval merchants knew how to price risk. When asked about the project, Giulia said she applied for the role because she immediately saw the connection between this project and her interests in Corporate Law. She went on to say that the opportunity to learn more about some of the lesser known elements of Italian history has been very insightful. Both students have also been assisted by ICMA Centre student Kunhui Luo, who studies BSc Finance and Investment Banking.

Alfie Wardle (UoR) and Karla Jimenez Bonilla (UMW) have been looking at the foreign exchange (FX) market in the middle ages, and whether there are seasonal FX patterns at different medieval financial centres. Karla has been working to analyse the historical context of the data to explain the trends shown in the regression analysis. Originally from El Salvador, we asked Karla about her first impressions of Reading. “I like Reading, it's a small but pretty town. I love the architecture of the old buildings - the Abbey Ruins are one the most interesting places I've seen so far.”

The project will run until the end of July and is supervised by Dr Tony Moore, Dr Chardin Wese-Simen and Professor Charles Sutcliffe.

| Published | 29 June 2018 |

|---|