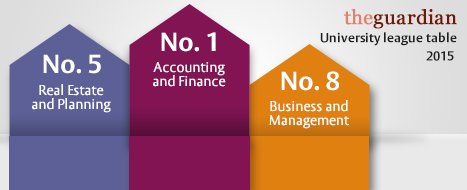

Ranked first in Accounting and Finance degrees in the Guardian University league tables

Yesterday the Guardian newspaper released its full league tables by subject for 2015, with the University of Reading ranking in the top ten across all programmes offered at the Henley Business School.

The ICMA Centre underlined its excellent reputation for finance programmes as the University of Reading ranked first in ‘Accounting and Finance’ with a Guardian score of 100/100. The Guardian ranked the University of Reading as No. 1 thanks to a high score in all student measures, including the quality of teaching and overall programme, reflecting the attention the ICMA Centre and Henley Business School place on continually improving their degree programmes.

Dr Ioannis Oikonomou, Director of the BSc in Finance and Investment Banking at the ICMA Centre commented:

This is fantastic news and a clear reflection of the importance that the ICMA Centre, and Henley Business School as a whole, place on effective, practical, high-level teaching. The very high student satisfaction numbers across the board combined with great student to staff and expenditure per student ratios have placed our undergraduate degrees at the very top of the list and we could not be more proud of this. We will strive to ensure that our BSc in Finance and Investment Banking along with our other newly established undergraduate degrees in Finance remain among the UK's elite.

The newly launched undergraduate degrees in Finance, include the BSc Finance and Psychology and BSc Finance and Management with the University of Venice, which offer uniquely designed courses integrating finance theory with real investment banking practice.

You can find out more about the ICMA Centre, the home of finance programmes at the University of Reading, by reading about our undergraduate, postgraduate and research offerings and information about our state of the art facilities, including our three Thomson Reuters equipped dealing rooms here.